FarmaForce Limited (ASX:FFC) has delivered more evidence of its continued growth as Australia’s premier healthcare contract sales organisation (CSO) with its latest ASX announcement, showing a 100% increase in sales in Q3 FY19 compared to Q3 FY18.

With a 57% compound annual growth rate (CAGR) over the last four years, FarmaForce is significantly outperforming Australia’s pharma market, which has grown at just 4.3% over the same period1.

The recent release of FarmaForce’s Appendix 4C Quarterly Cash Flow Report for the period ending 31 March 2019, shows continued momentum of strong sales growth and margin.

The key highlights of the report are:

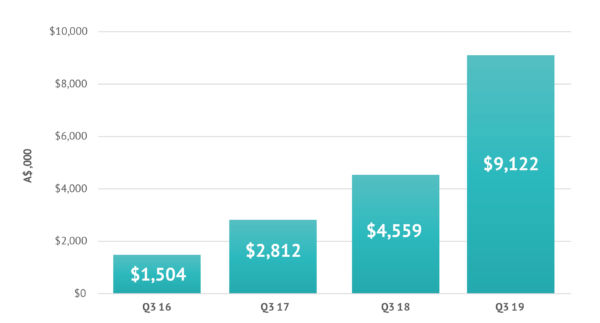

- An increase of 100% in receipts from customers for Q3 FY19 when compared to Q3 FY18 (Q3 FY19 $9,122K; Q3 FY18 $4,559K).

Q3 FY16-19 Customer Receipts

- Strong margin leverage from operational excellence and productivity projects resulted in an operating net cash inflow of $454K (Q3 FY19).

- Cash at the end of Q3 FY19 was $848K, which was an increase of $401K compared to the end of Q2 FY19.

- FarmaForce continues to maintain a financial position of zero external debt.

FarmaForce also launched a third primary care team to accommodate new customer demand and expansion.

“Our Q3 Cash Flow Report reflects the operational and sales success that continues to cement FarmaForce’s position as Australia’s premier healthcare contract sales provider,” FarmaForce General Manager Harry Simeonidis said.

Click here to view the full Quarterly Cash Flow Report for period ending 31 March 2019.

1 The Global Use of Medicine in 2019 and Outlook to 2023: IQVIA Institute